This will take a few moments to read, but it’s worth the effort. It’ll give you some great content to share with clients and prospects. It will also make the case why you will thrive in this market if you stick to the basics.

The media fixates on the average home price in Denver. That’s influenced by the price in different segments (e.g., FTB first time buyer, trade up, luxury) as well as the mix of what homes are selling.

No one, including me, expected the problems with getting jumbo loans at reasonable rates. Odds are, the problems in the conventional mortgage market in general, and the jumbo loan market in particular, will be corrected in the next 4-12 weeks. But it’s hard to know how fast that will happen.

Let’s look at a simple example of a mix variance.

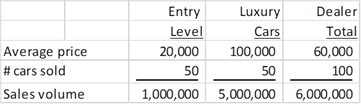

Imagine you own a car dealership, and you sell only entry level cars (FTB) for $20,000 and luxury cars for $100,000. You sell 50 of each. The average price is $60,000.

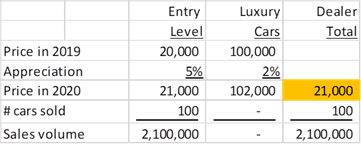

Next year, the entry level car is 5% more expensive; the luxury car is 2% more expensive. But loan programs are not available for luxury cars. Everyone just buys an entry level car. You still sell 100 cars.

Now your average sales price is $21,000. The price of each type of car went up, but the average price went down. A cost accountant calls this a mix variance.

Let's try it with houses

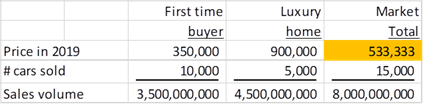

A typical FTB (first time buyer) property might cost $350,000 (small homes and condos). A typical luxury home (top 10% of the market) is around $900,000. We sell around 50,000 properties a year in Denver. FTB might be around 10,000 homes. Top 10% (luxury) is around 5,000 homes.

correction: # homes sold

The average home price is $533,000 (which is close to the actual average).

Entry Level Homes

Appreciation Rates

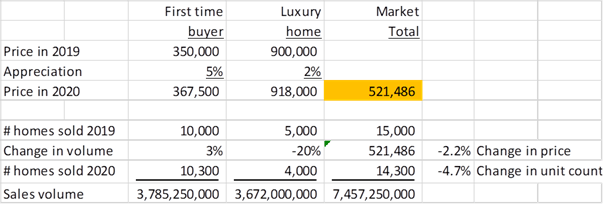

As of mid-March, entry level homes are currently experiencing a modest increase in inventory. Instead of a very strong sellers market, it’s merely a seller’s market. So instead of 7-9% appreciation in 2020, perhaps we’ll see 5%.

Sales Rates

Once this COVID crisis settles down (late 2Q, early 3Q), sales count could increase for FTB since there is plenty of pent up demand. Imagine sales count for FTB goes up 3%.

Luxury Homes

Appreciation Rates

Luxury homes have had a larger increase in inventory. Luxury homes will go from a moderate sellers market to a balanced market. Perhaps they see only 2% appreciation in 2020.

Sales Rates

Luxury homes sales are flat to declining… and that’s before the jumbo loan shortage. Sales volume will likely be lower in 2Q, and due to financing problems, the unit count sold goes down 20%. (it’ll probably mostly recover in 3Q)

You can see the average sales price drops from $533,000 in 2019 to $521,486 in 2020, or -2.2%. The price for each type of home went up, but since the mix changed, the average price goes down. Also notice there’s a meaningful drop in the total number of homes sold, -4.7% in this example.

There’s a decent chance this will happen in 2Q.

2Q Volume will drop 20%+ from 2019. The headlines will make this sound like the end of the world. The average price could go down modestly. All the doomsday predictors will be pointing and saying “I told you so, prices went down”. You’ll need to be able to explain this to help them understand that while the average price went down, the price of each individual house still went up a little. I expect strong volume increases to make up for this in 3Q. We’ll end up selling 12 months of real estate in 9 months, since 2Q will be soft.

What does it mean for agents?

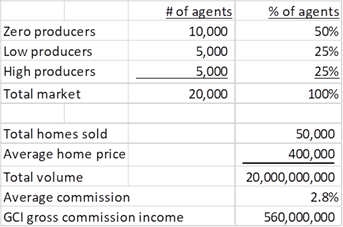

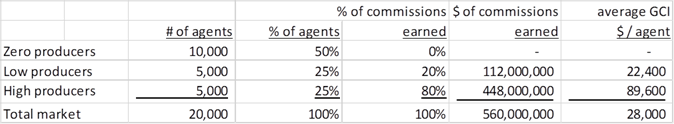

Remember that 50% of agents sell 0 deals a year, about 25% sell 1-3, and 25% sell 4+.

With 50,000 homes sold at $400,000 each (average of homes and condos – this is a simplification to make this easy to follow), there’s $20 billion of residential real estate sold. That generates around $560 million of GCI (gross commission income).

It’s not a perfect pareto (80/20) rule, but it’s pretty close.

The average income of the high producers is around $89,600 in this simple example.

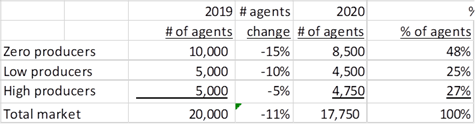

In an expanding economy, more people get their license. In a recession, some agents give up their license, and the number of people in real estate school declines. This doesn’t happen overnight (at least not in 2007-2009), but over the course of a year or so.

This COVID issue might prompt 10% or so of the agents to exit the market.

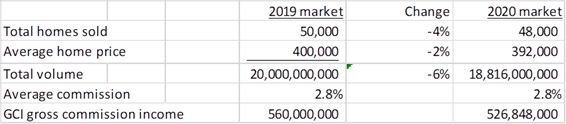

As outlined at the top, imagine the number of units goes down 4%, and the price goes down 2%. Total market GCI goes down about -6%

In the last recession in 2008, the number of agents declined faster than the GCI. The higher producers took market share from the lower producers. Some consumers think anyone, including their newbie cousin or a discount broker, can sell their home in a hot market. They are more likely to want a full service, experienced pro in a challenging market. Also, discount brokerages and FSBO lose market share in every downturn, so the average commission % tends to go up somewhat. You have already seen iBuyers like Zillow and Open Door exit the Denver market. Netting all of this out, many high producers had a slight increase in GCI in the last recession. I think it’ll happen this time, too.

This recession will be much more severe (in terms of % GDP decline)...

...but the recovery will be fast.

The producers should still gain share. This is your opportunity.

Be an expert, be able to explain the trends clearly to clients.

Be a contrarian and keep a positive mindset in the face of scare-mongering headline.

Really understand how your marketing approach will be different for the COVID environment (which is what we have been covering on the webinars. We recorded them if you missed them). Make your calls. MAKE YOUR CALLS!

If you make more calls than you usually do over the next 8-12 weeks, you will set up an excellent pipeline for 3Q after this COVID issue is under control and out of the headlines. You will take market share from the weaker producers.

The headlines will get worse for several weeks, but don’t take your eye off this opportunity.

If you actually had the patience to read all of this, please let me know. It’d be nice to know I got up at 3:30 AM for a good reason!

Lon Welsh

Co-Founder and Director of Client Development

First Alliance Title