The market update for Sept from the MLS has been released.

The showings / active listing traffic last month was pretty strong – better than last year. Here are some key points:

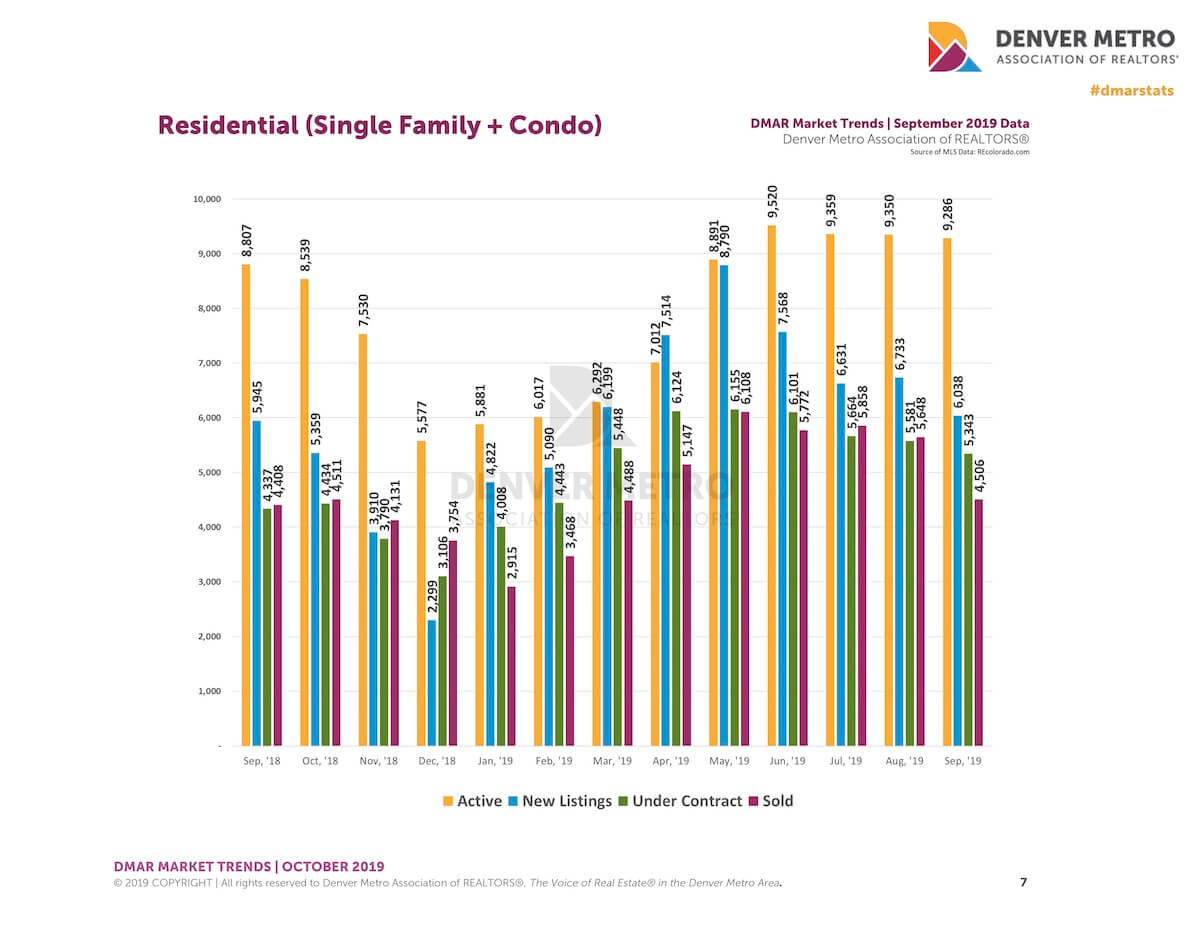

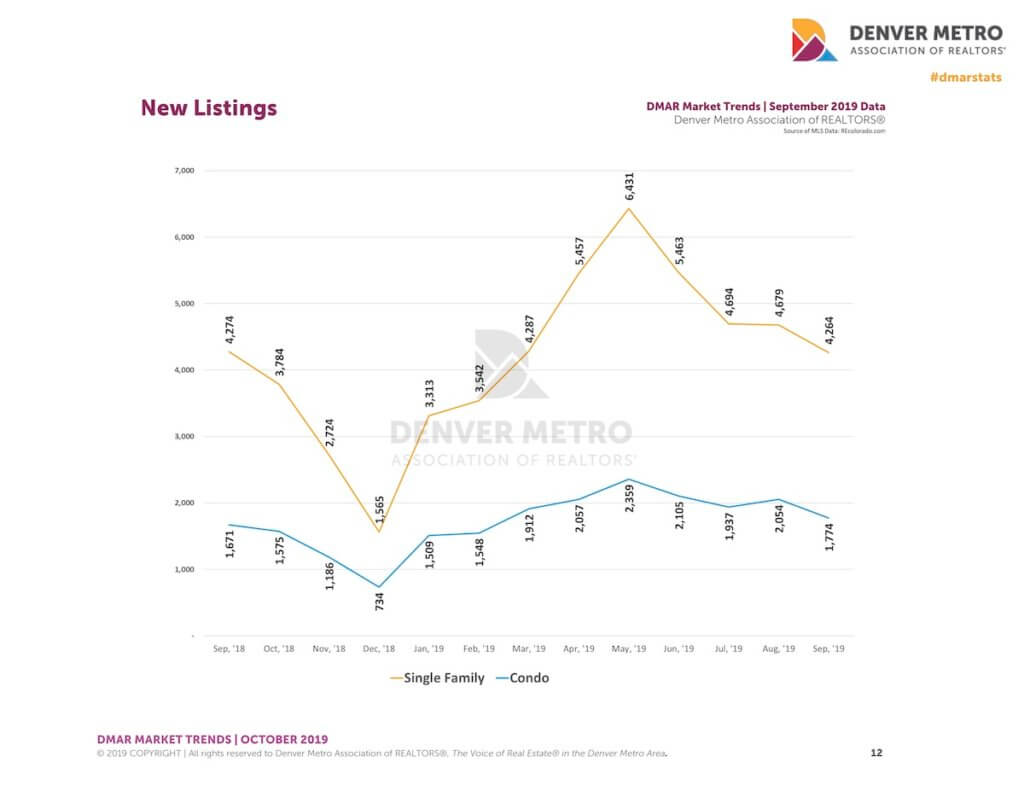

The pace of inventory build has slowed a LOT. In the first half of 2019, inventory was up +20% or so from same period last year. However, last July 2018, interest rates increased rapidly, then buyers lost some interest in purchasing. As a result, inventories in the late summer / early fall 2018 increased quickly.

The Sept ’19 inventory was only +5% from Sept ’18. There was essentially no change in inventory between Aug ’19 and Sept ’19. The inventory build seems to have stabilized.

There were 4,500 sold properties in Sept ’19, +2% from Sept ’18. There was the typical seasonal slowdown where Sept 19 was off in unit count from Aug ’19 by -20%. Normal.

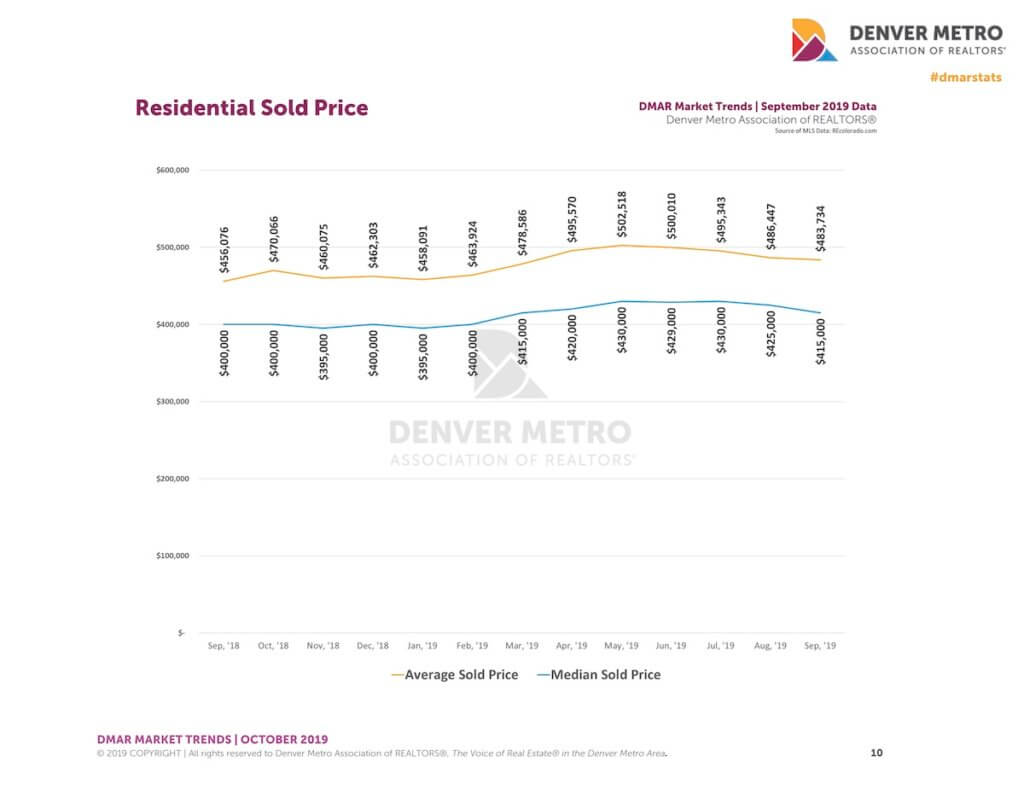

Year over year sales price is up +4%. This appreciation had been in the 7-9% range for several years, so I’m glad to see it slowing to a lower pace. Wages are going up at about this rate, so it helps with affordability, and first time buyers (FTB) can still have a shot to purchase.

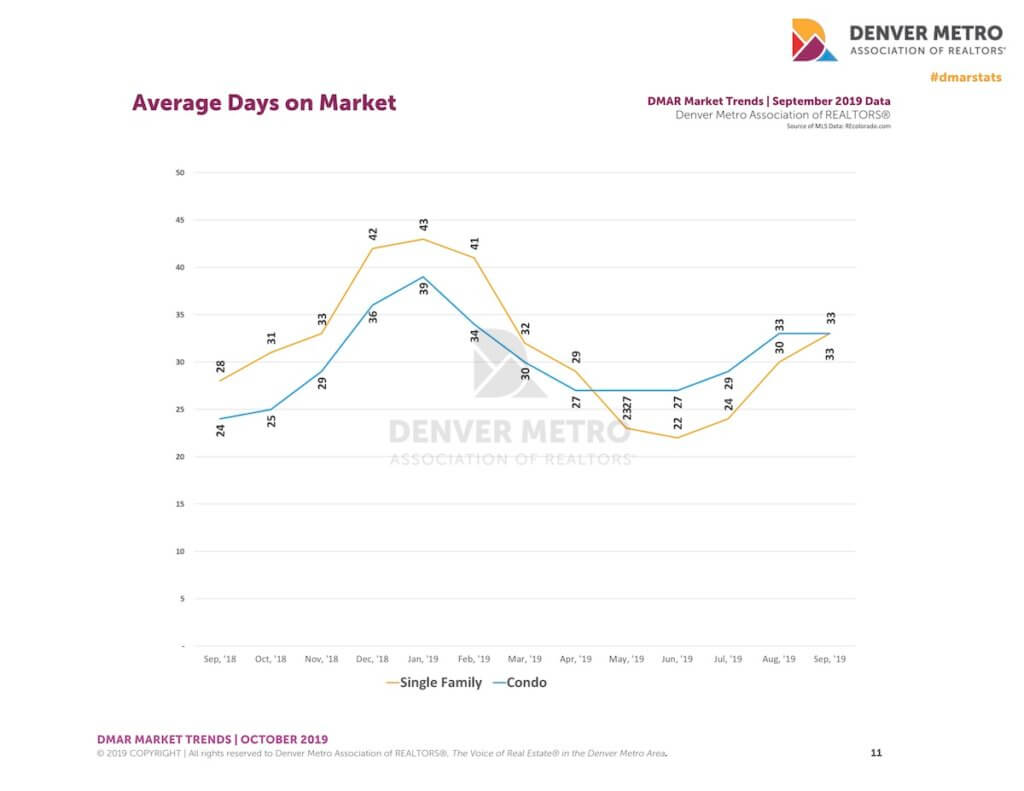

DOM, at 33 (overall), is up a few days from same time period last year.

If you dis-aggregate condos from single family, there are not any meaningful changes from the large trends discussed above.

Additional Insights

Properties Requiring a Price Reduction

In Aug ’19, 37% of sold properties required a price cut vs. 31% in Aug ’18. That is likely to stabilize, I think, for the next year or so.

Many economists in the Wall Str Journal still expect a mild recession, perhaps starting in late 2020. Inventories will increase and sales unit count will slow a bit when that happens.

Properties that require a price reduction to eventually go UC take an average of 58 DOM vs. 13 DOM for properties that are correctly priced on day 1. This is very consistent with our findings over the past few years. That’s not going to change anytime soon.

The % of deals with seller concessions continues to increase modestly… however, the amount of the concession (median is around 1%) isn’t that big.

Low Mortgage Delinquency Rates

Core Logic found that Denver property owners are sitting on a record high amount of home equity. Don’t expect foreclosures or short sales to return anytime soon. Additionally, Colorado has some of the lowest mortgage delinquency rates (over 90 days late) of any state in the US. There’s no evidence of a bubble like we had in 2007.

Short Term Rental Sales

The DMAR report claims “we are seeing more properties that were previously short term rentals being sold”. I could suspect that is true, but I can’t think of any way to prove that beyond water cooler story sharing. In other words, this is a fairy tale being passed off as news. If any of you can think of an analytical way to prove it, let me know and I’ll have the team do the work to find out. That would be a good insight to have.

Stop Renting and Buy

If your FTB needs a kick to get looking, remind them that rents were up 4.3 % in the past year… rents are going up faster than house prices. This, combined with amazingly low interest rates, really creates a great opportunity for FTB to buy.

It's still a seller's market

While the MOI (months of inventory) increased earlier this year (as the inventory increased), it’s STILL a seller’s market … just a less strong seller’s market. Now that inventory growth has stalled, we’d expect the negotiation balance of power to stay about as it is for the next 6 months or so.

Fall is a good time to list

For buyers, they are much more likely to get a deal or concessions NOW than they will in spring, so NOW is the time to act.

If you are a trade up buyer, you are MUCH more likely to get a contingent offer accepted in the fall than you are in the spring, so the time to act is NOW.

Get the message out, educate your clients, and you should have a busy 4Q.