Homebuyers, especially in newly developed areas, should pay special attention to the taxes they may be paying for inclusion in a special district. Property taxes in one area of a county may have substantially different tax rates than another area in the same county depending on whether the property falls within the boundary of a certain special district. In fact, special districts taxation represents upwards of 19% of the total property taxes across Colorado.

What is a special district?

Special taxing districts are quasi-governmental entities formed to finance, develop and manage areas outside the existing infrastructure of a municipality. The district imposes a special tax on the new development in that area and issues municipal bonds which are backed by the anticipated tax revenue from that tax.

How does the special district mill levy impact my tax bill?

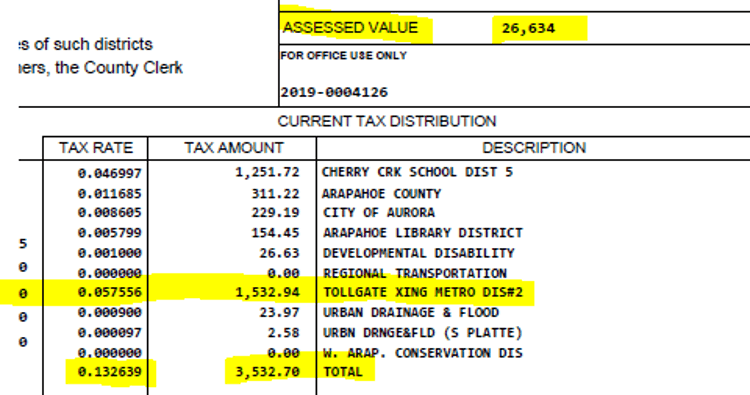

Property taxes are computed by multiplying the “assessed value” of your property by your local mill levy (the tax rate). Keep in mind, the assessed value is NOT the price you paid for your home. It’s only 7.15% of the market value, so much less. Many assessor websites have information about the assessed value and the mill levy for your property. However, the most reliable source of information is an official Tax Certificate, which is provided to you with your title insurance commitment.

A snapshot from this tax certificate shows the portion for the special district “Tollgate Crossing” is $1,532.94, which is more than 40% of the total tax bill.

Knowing the tax rate attributable to a special district is only part of the analysis. One must also consider the value of the infrastructure, amenities, etc. that the special district provides for the property. A particular special district may appear expensive, but it might also cover a lot of community expenses that might otherwise not be available, or paid by other means, like a homeowners association.

For more information about how property taxes are handled during the closing process, please contact us.

This information should not be considered legal advice.

Attention Brokers:

We created a PDF with information about Special Districts. The flyer can be placed in your buyer agency listing appointment packet.